Asparagus

Prices are poised to rise as demand strengthens through this month. Mexican supplies are expected to tighten through the end of the year. Markon First Crop (MFC) Asparagus is available.

Mexico

- Current quality is fair; elevated levels of feathered/spread tips and reduced shelf-life have been noted

- The Baja season is past peak production and winding down

- Production will move north and east towards Caborca, Sonora, and Mexicali over the next month

- Size is dominated by small spears

- Markets for the extra-large and jumbo sizes remain elevated, while prices for small and standard sizes are at average levels

- Limited supplies are forecast for the next six to eight weeks; there is potential for a short-lived supply gap near the first of the year as suppliers shuffle between harvesting regions

Southern Peru

- Imported stocks (shipped into Miami, Florida) are steady and set to increase over the next three to six weeks

- Quality is strong and holding up well, despite the longer transit time

- Production out of Northern Peru will be essential to smooth any supply gaps and calm markets over the next one to two months

Bell Peppers

Overall green and red bell pepper supplies are moderate but strong demand is pushing up prices. Production is transitioning to new growing regions on both coasts. MFC and Markon Essentials (ESS) Green and Red Bell Peppers are available.

Green Bells

- California has moderate volume primarily out of the Coachella desert region

- Quality is very good

- All sizes are available

- Demand is strong

- Mexican supplies are starting to ship into Nogales, Arizona; full production will start in early December

- Volume is low out of Central Mexico (crossing into South Texas)

- The Georgia season is expected to run through November but cooler weather bring it to an end before December; quality is fair

- Ample stocks are shipping out of North and South Florida; the Central Florida season will begin in early December

- Markets are expected to remain steady for the next e few weeks

Red Bells

- Production is moderate in California’s coastal regions

- Large sizes are snug

- Quality is good

- Supply levels are steady out of Jalisco, Mexico (crossing into South Texas)

- The Canadian greenhouse season is ending; demand has shifted to California

- Expect high yet steady prices over the next two weeks

Celery

The celery harvesting transition from Salinas to Oxnard, California is underway.

- MFC Celery is available

- The Oxnard season is ramping up

- Salinas production will run through late November

- Harvests will continue year-round in Santa Maria, California

- Production will begin in Coachella, California in early December

- The season in Belle Glade, Florida will start in mid-December

- The Yuma, Arizona season will get underway in late December/early January

- Quality is excellent in all regions; Fusarium disease pressure is minimal in initial Oxnard lots

- Demand is strong for the holiday season

- Markets are expected to remain fairly steady through November

Green Leaf, Iceberg, and Romaine

- MFC Premium Green Leaf, Iceberg, and Romaine are limited; Markon Best Available (MBA) and packer label are being substituted as needed due to low weights

- The primary transition from the Salinas and Santa Maria Valley’s to the Arizona/California desert regions will occur this coming weekend; Salinas supplies will be depleted by mid- to late November

- Huron and Oxnard, California supplies are winding down; supplemental seasons will finish this week

- Quality remains very good for this time of year, but weights are low in all regions

- An extended heatwave in October stunted growth and current unseasonably cold temperatures in the Arizona/California desert are further stalling growth in young fields

- Markon Quality Assurance is working closely with suppliers in all regions to identify the best lots

- Markets remain extremely active, especially for iceberg lettuce; expect elevated prices through early December

- Markon’s Salinas cross dock will close for the season on Sunday, November 17; the Yuma cross dock will open on Monday, November 18

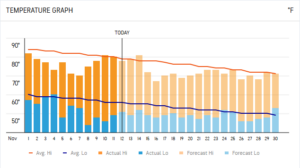

Yuma, Arizona Temperatures

Mixed Berries

Blueberry supplies have increased; raspberry and blackberry supplies have also improved with weather conditions.

Blueberries

- Demand currently is steady; quality is good

- Mexico’s production has begun

- Offshore shipments from Peru are arriving and being off loaded on time; Chilean shipments will begin in December

- Expect better supplies as markets decrease

Blackberries

- Mexico’s yields increasing as weather improves

- Quality is fair; soft skins and red cells have been reported

- Expect better quality moving forward

- Pricing will slowly decrease

Raspberries

- Central Mexico weather has improved, increasing stocks and availability

- Sizing is dominated by medium berries

- Quality is fair; over-ripe berries with light crumbling (individual cells separate from the berry) have been reported

- Demand is steady

Onions

Onion prices continue to rise as demand increases for the holidays; expect elevated markets through November.

- MFC Onions continue to ship from Idaho, Oregon, Washington, Utah, and Colorado

- Yellow and red onion demand has increased as the Thanksgiving holiday nears; expect prices for medium and jumbo sizes to rise

- Mexico’s strong demand for white jumbos has pushed prices up and tightened supplies

- Red and yellow onions are available in Michigan; medium-size supplies continue to dominate the crop

- New York is shipping limited red and yellow stocks through late December; white onions are not available

- Storage quality is excellent

Ready-Set-Serve (RSS) Raw Product

Raw product supplies for RSS Iceberg, Romaine, and Tender Leaf items continue to tighten across California and the Arizona desert growing regions.

- Raw product supplies are short in multiple growing regions

- The primary transition from the Salinas and Santa Maria Valleys to the Arizona/California desert regions is ongoing; Salinas supplies will be depleted by mid- to late November

- Production is winding down in Huron and Oxnard, California as well; these supplemental seasons will conclude in mid-November

- Yields are higher in Guanajuato, Mexico; supplies from this region are being substituted to prevent shortages

- Quality is very good for this time of year; however, weights are low in all regions due to an extended heatwave in early October

- In addition to heat-related growth challenges, the Arizona/California desert is experiencing persistently strong winds, further stunting growth and dehydrating heads

- Markets are active; expect elevated prices through late November, at minimum

Spring Mix

Markon’s Ready-Set-Serve (RSS) Spring Mix is limited; packer label is being substituted as necessary.

- The Salinas Valley is nearing the end of the season; supplies are very limited for all tender leaf varieties

- Quality is good to fair; increased discoloration, mechanical damage, windburn, insect damage, and early breakdown are being reported

- Colder temperatures and increased winds are slowing down plant growth in both the Arizona/California desert regions and Salinas Valley

- Sporadic rain is forecast to move through the Salinas Valley over the next 2 weeks, causing concerns for quality issues and muddy fields

- Expect elevated markets through November as suppliers transition from Salinas to the desert growing region

Strawberries

Recent rainfall did not end the Salinas/Watsonville, California season prematurely as predicted, but volume is falling and quality has suffered. Demand for Santa Maria and Oxnard strawberries is strong. Production is underway in Mexico (into South Texas). Expect markets to increase, as overall yields are low.

Salinas/Watsonville

- Stocks continue to diminish as the season winds down

- Volume is down at least 50%

- Size currently ranges from small to medium (24 to 28 berries per one-pound clamshell)

- Quality is fair; some softness and early decay has been reported

Santa Maria

- MFC Strawberries are available

- The fall crop has passed its peak and continues to downtrend

- Size currently ranges from small to medium (48 to 53 berries per two-pound clamshell)

- Quality is very nice; softness and green shoulders have been reported

- Expect markets to climb as yields fall

Oxnard

- MFC Strawberries are available

- Volume is increasing, helping fill the industry void from other growing regions

- Size currently ranges from medium to large (18 to 21 berries per one-pound clamshell)

- Quality is very nice; color is deep red color and flavor is sweet

- Expect tight markets

Mexico (into South Texas)

- Early season volume is low

- Quality is good; some small size and white shoulders have been reported

- Expect increasing supplies (crossing into San Juan, Texas) over the next two to three weeks

- Expect markets to remain active

Florida

- Production has been delayed until after Thanksgiving due to October’s hurricanes

- Growers are reporting small size and odd shape in early season mud crop supplies

- Size ranges from 23 to 25 per 8/1-pound clamshells

- Quality will improve as the weeks progress

Tomatoes

Demand for Roma and round tomatoes is shifting to Mexico due to the damage Hurricane Milton caused in Florida. Expect higher markets over the next month. MFC Tomatoes are available; packer label may be substituted in some instances.

Round

- East Coast production is extremely limited due to past hurricanes

- Growers have enacted Act Of God clauses

- Florida’s Ruskin/Palmetto region has very few salvageable supplies that are best suited for processing

- The South Florida season is expected to start in late December

- Mexican markets are expected to rise next week due to reduced availability and increased demand

- 4×5 packs are exceptionally tight

- Baja growers have begun harvesting limited supplies; however, overall acreage is down

- Crops from Central and Eastern Mexico (crossing into Sout Texas) are in seasonal decline; production will end in late November

- The main Culiacan growing season, which has avoided severe weather so far, is expected to begin in late December

- Expect higher pricing over the next two weeks

Roma

- East Coast stocks are extremely snug

- Production is winding down in Georgia and Quincy, Florida this week

- The Ruskin/Palmetto region has extremely low volume dominated by small sizes and No. 2 grade fruit

- The South Florida season will start in late December

- Expect limited availability and higher markets over the next five weeks

- Growers will continue steady/light harvesting out of Central Mexico and the Baja Peninsula over the next month

- Central Mexico is past peak production; quality is fair

- Baja growers have transitioned to newer fields; however, overall acreage is much lower during winter months

- Roma prices are slightly higher but much lower than markets for rounds this week

- Markon recommends substituting Romas for round tomatoes for the next six weeks, if possible

Grape & Cherry Varieties

- Grape tomato supplies are tightening

- Florida growers have ended harvesting in Ruskin/Palmetto due to heavy damage caused by Hurricane Milton; expect extremely limited stocks until the South Florida season starts in three weeks

- Suppliers are starting fall harvests in Baja; cool weather has slowed production

- Volume is moderate in Central Mexico; quality varies by grower and lot

- Expect higher prices next week

Please contact your Markon Account Manager for more information.

©2024 Markon Cooperative, Inc. All rights reserved.